Stocks fall back to depression

Image collected

Stocks failed to maintain the momentum of the previous day that saw the biggest single day rise since April 1, 2018, which suggests retail investors remain unconvinced by regulators’ actions to prop up the flagging market.

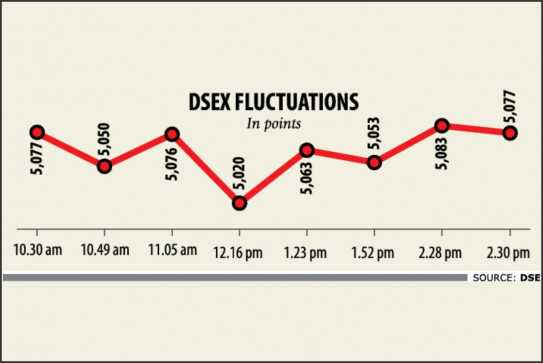

DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), closed yesterday at 5,077 points, which is the same as the previous day, but it oscillated the whole day.

Within 18 minutes of the start of trade, the index slipped to 5,050. It bounced back to 5,077 at 11.06am only to plunge to 5,020 points 70 minutes later.

At 2:28pm, it bounced to 5,083 points, but it eventually settled at 5,077 points.

Expectedly, turnover rose 20 percent yesterday to Tk 380.59 crore compared to the previous day.

General investors remain unconvinced by the actions of the Bangladesh Bank and the capital market regulator to defibrillate the market, so despite a jump of 111 points on Tuesday most of them washed off their portfolio, market insiders said.

Between June 28 and July 22, the index had lost 463.6 points and investors’ Tk 27,500 crore were wiped out, thanks to unfavourable measures for the capital market in the budget for fiscal 2019-20.

This prompted the central bank on Monday to verbally ask banks and non-bank financial institutions that have the capacity to invest to support the market. As per its information, 19 lenders have the scope to park Tk 2,000 crore in the market.

Similarly, the Bangladesh Securities and Exchange Commission asked the DSE to order all stock brokers to ensure due authorisation from their clients for sell orders before placing them into the system.

In other words, investors would have to physically go to the brokerage house to place the sell order instead of just picking up a phone.

The BSEC yesterday requested the stock dealers, asset management firms and merchant banks to support the market as much as possible.

Even more, the BSEC informed the institutional investors that it would monitor if they were supporting the market or not.

Institutional investors poured money whenever the market dropped yesterday, the market insiders said.

“We are keeping the request of the regulators and purchasing some shares considering their potential,” said a top official of a leading merchant bank.

However, the merchant banker is also dreading the index fall further.

“We are keeping aside money to buy if the market falls further but we will not be able to provide support for a long time,” he said requesting not to be named.

Of the traded issues yesterday, 143 advanced, 178 declined and 32 remained unchanged.

Meanwhile, retail investors yesterday demonstrated in front of the DSE building to ensure good governance in the listed companies and the stock market.

They also demanded implementation of all rules and regulations, including ensuring minimum shareholding by directors of listed companies. They have another 13 demands.

Square Pharmaceuticals dominated the turnover chart with its transaction of 5.83 lakh shares worth Tk 14.59 crore, followed by Bangladesh Shipping Corporation, United Power Generation, Fortune Shoes and Beacon Pharmaceuticals.

C&A Textiles was the day’s best performer with its 10 percent gain, while Heidelberg Cement was the worst loser, shedding 8.74 percent.

Chattogram stocks rose with the bourse’s benchmark index, CSCX, increasing 4.93 points, or 0.05 percent, to finish the day at 9,439.55.

Losers beat gainers as 134 declined and 126 advanced, while 15 finished unchanged on the Chittagong Stock Exchange.

The port city bourse traded 78.33 lakh shares and mutual fund units worth Tk 16.68 crore.

Source: https://www.thedailystar.net

Tags :

Previous Story

- Stocks rebound on regulators’ intervention

- Price fall in large-cap drives stocks down

- Stocks continue to bleed, Tk 23,142cr lost in...

- Stocks plunge for 3rd week on panic sales

- Stocks inch up as institutional investors keep supporting...

- Dhaka Bourse to Develop Tradeable Capital Market Indices

- Investors continue demo against stock market slump

- DSE plans to make indices tradable