Wrong actions ruin Bangladesh sugar industry

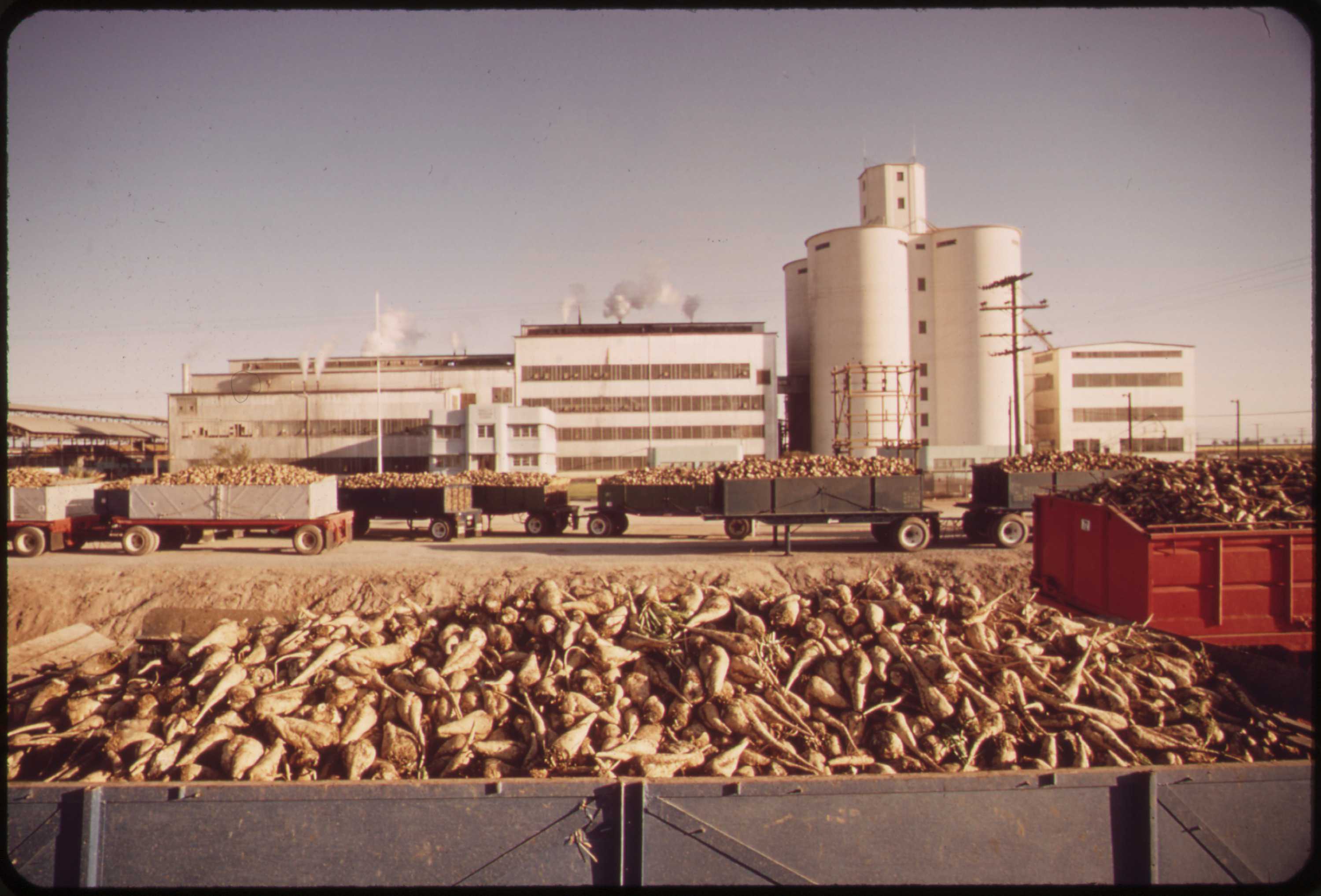

Image: Collected

The liberalisation of sugar import possesses subjected the ailing state-possessed sugar mills to an uneven competition, delivering them to the brink of collapse with the procedure in six of the 15 public mills currently suspended.

Regarding to economists, Bangladesh’s sugar mills are uncompetitive largely because of their high production cost as the withdrawal of limitations on the import of affordable sugar has switched their condition from terrible to worse, producing their fall inevitable.

While six private companies own benefited from the liberalisation, a large number of sugar cane farmers, sugar mill personnel and thousands other people who have designed their lives around sugar mills include lost or are going to eliminate their livelihoods, they explained.

The liberalisation has taken with it some clear privileges for importers, such as for example import-tax relaxation, slowly but surely pushing the neighborhood sugar market to the border while successive governments haven't acted to safeguard or revitalise the neighborhood industry.

Nor gets the government taken actions against importers because they did not export 1 / 2 of the result they processed, a state imposed through the liberalisation on importers.

The importers were as well necessary to help the government keep carefully the market stable, but rather they have held the neighborhood mills under stress and anxiety by retailing sugar at a minimal price.

‘Making the remarkably inefficient, corruption-ridden localized sugar industry to contend with the highly useful and skilled overseas sugar industries is similar to making a kid challenge a monster,’ MM Akash, who teaches economics at Dhaka University, told MODERN recently.

‘The kid will lose the struggle unless protected and taught up to handle the monster,’ he noticed.

Because the sugar import was liberalised in 2002, the country’s sugar cane cultivation acreage fell by 45 % to slightly over 48,000 hectares in 2019 from a lot more than 88,000 hectares in 2002, resulting in over 66 % fall in the development, reveals the Bangladesh Sugar and Foodstuff Industries Corporation’s data.

In 2019, until when comprehensive yearly government info was available, about 69,000 tonnes of sugar was developed weighed against 2,04,000 tonnes stated in 2002.

Only one time in the 47 years because the country’s independence does sugar cane acreage dip consequently lower in 1973 with sugar cane cultivated on near 48,000 hectares in the war-ravaged Bangladesh.

In the 18 years because the sugar import was liberalised, the BSFIC saw earnings only one time in 2005-06, the entire year sugar mills had an excellent output and also a considerable import.

State-owned sugar mills produced earnings in 10 of the first of all 12 years after Bangladesh’s independence. However, in the 17 years after 1984-85, the BSFIC saw profit simply twice.

The share of the neighborhood sugar industry in interacting with the country’s demand fell to significantly less than 4 % in 2019 from about 20 % in 2002, the entire year the import liberalisation was allowed in Bangladesh.

The gap between your production cost and the marketplace price of sugar likewise saw an abnormal boost after the liberalisation.

In 2002, the creation cost of every kilogram of sugar was Tk 34 as the selling price was Tk 27. However in 2019, the production price skyrocketed to Tk 219 a kilogram, practically four times the marketplace price of Tk 55.

While mismanagement and corruption was partially in charge of the decline in creation and the spike in development cost, economists explained, the import glut of low-priced sugar also played a substantial role in putting the neighborhood sugar market in distress.

‘After the import of low-cost sugar started the neighborhood sugar market lost their market suddenly acquiring it hard to acquire buyers because of their costly merchandise,’ said MM Akash.

In 2002, regarding to BSFIC info, each kilogram of refined sugar purchased for approximately Tk 13 on the international industry against the then native selling price of Tk 27.

In 2019, the foreign selling price of a kilogram of sugar was about Tk 28 against the neighborhood selling price between Tk 44 and Tk 55.

While importers profited drastically from low international industry prices, state-owned sugar corporations experienced a reliable rise within their losses, struggling to bear the regular high fixed costs such as for example salaries and huge home maintenance spending because they were forced to market their sugar at rates much less than their production cost.

Dhaka University’s accounting and facts devices associate professor Moshahida Sultana studied the consequences of the liberalisation of sugar import on state-possessed sugar mills in 2016.

‘A deep good sense of uncertainty occur over the local sugar industry following the import of low-cost sugar commenced and their market show speedily increased,’ said Moshahida.

Source: http://www.newagebd.net

Tags :

Previous Story

- Bangladesh garment industry 'on danger' - BGMEA

- Keeping craftsmanship, and the marriage industry

- Students against privatisation of the jute industry

- NOAB urges govt to the stand by position...

- How exactly to revive our apparel exports

- COVID-19 and its impact on Bangladesh economy

- Dairy farms demand larger tariffs in dried milk...

- Shrimp industry seeks particular financial aid