37pc employees in smaller businesses lost jobs: survey

Image: Collected

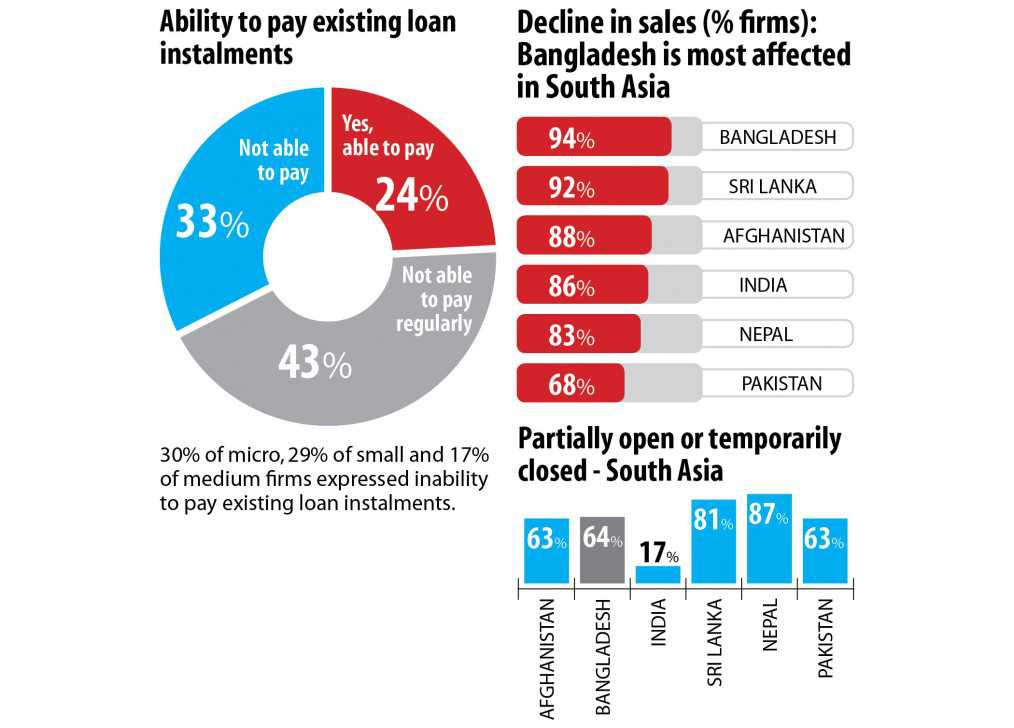

A whopping 37 % of employees in the micro, small and medium enterprises (MSMEs) lost their jobs, either temporarily or permanently, within a month and 94 percent of MSMEs experienced a sharp drop in sales as a result of the coronavirus pandemic, according to a fresh survey.

The analysis -- Business Pulse Survey: Impact of Covid-19 On MSMEs in Bangladesh -- shows that 70 percent of most workers are actually in vulnerable jobs, with businesses either temporarily closed or only partially open.

This led to calls for ramping up policy support for the MSMEs to prevent their downfall amid plummeting sales and save jobs as only 2 percent of them received support from the state.

"This indicates that policy support is not reaching a huge number of its target population. The proportion is even lower for micro firms, which stands at 1 %," the report said.

Forty-nine percent of micro-businesses reported that they didn't have adequate liquidity to sustain themselves for another three months, compared to 40 percent and 33 % respectively of small and medium-sized firms.

The survey was carried out in Bangladesh by International Finance Corporation (IFC) and World Bank, together with the UK's Foreign, Commonwealth, and Development Office (FCDO) from June 4 to 15.

"We will work hard to bring the economy back to its normal stage," said Fazle Kabir, governor of Bangladesh Bank, while addressing a webinar marking the report's launching yesterday.

"We are committed to implementing the stimulus packages and have instructed banks to supply loans to the cottage, micro, small, and medium enterprises at subsidized interest levels."

Beneath the survey, 1,044 calls were made, of which 516 were successful.

The final 500 MSMEs surveyed are distributed across all eight divisions and 12 sectors, including fashion, clothing, agriculture, fishing, mining, retail, wholesale, transport and storage, food services, leather, plastics, and information, and communication.

In line with the findings, 91 % of the firms suffered the worst decline in cash flow. Similar economies such as for example Vietnam witnessed 66 % while Indonesia 69 %.

It discovered that 37 percent of women-owned organizations had temporarily turn off operations, weighed against 21 percent of companies owned by men.

Around 83 percent of companies are incurring losses and 64 % are temporarily closed, the survey found.

Across the sector, 94 % of businesses experienced sharp drops in sales. These business losses have choked cash flows, with 33 percent of companies saying they cannot pay installments on existing loans.

MSMEs play a critical role in providing jobs. They employ 20.3 million Bangladeshis.

Now, 58 % of firms have reduced their working hours. More jobs are in danger as there appears to be no end to the pandemic insight.

In line with the IFC report, urgent steps are needed amidst this example to greatly help businesses survive.

"The federal government of Bangladesh has responded quickly and effectively by implementing stimulus packages and other policy measures to greatly help the MSMEs. But uptake till now has been slow."

The survey revealed that 76 % of firms were unaware of existing stimulus packages from any financial institutions.

"No doubt, as awareness increases, greater amounts of the MSMEs will touch base for help," the survey report said.

Poor usage of finance for the MSMEs is already a fundamental challenge in the centre of the country's financial and economical development. The SMEs in Bangladesh have problems with a $2.8 billion financing gap.

Supply chains and global value chains may also experience interruptions and further worsen the problem. Decreasing demand will further decrease the coffers of the MSMEs, as working capital commences to decrease.

This will cause their inability to pay salaries and may force them to lay off workers, driving up unemployment rates.

Overall, the survey shows a lot more than 80 % of businesses reported incurring losses in the month preceding the analysis.

"Micro, small, and medium enterprises are key drivers of Bangladesh's economy which account for about 25 percent of the GDP and employs over 20 million people," said Mercy Tembon, World Bank's country director for Bangladesh and Bhutan, in a news release.

"The Covid-19 pandemic has hit small businesses and informal workers the hardest with lack of income and jobs. In the years ahead, it will be important for Bangladesh to support the recovery of micro, small-medium enterprises, especially women-owned businesses and remove constraints to their access to credit."

The survey shows most businesses are expecting a negative effect on sales and jobs over another six months. Seventy percent of micro firms weren't optimistic about their future sales prospects.

"Even prior to the pandemic hit, these Bangladeshi businesses were already in a precarious position, as they operate on slim margins," said Wendy Werner, IFC country manager for Bangladesh, Nepal and Bhutan.

"The fact these companies are now in extreme distress highlights the urgent have to raise the resilience and capacity of these enterprises to allow them to ultimately preserve jobs and become on the road to recovery."

In order to recover from this crisis, businesses determined cash transfers, usage of new credit, and loans with subsidized interest levels as the most notable three most-needed policy supports.

Overall, 59 % of the MSMEs interviewed reported that low interest-rate financing will be the most reliable financial support to mitigate the crisis. Only 0.4 % of firms reported having obtained financial support from banks beneath the Covid-19 package.

Overall, 63 % of the organizations interviewed said they would require financial support for more than one year to revive business operations.

Sixty-nine percent of respondents reported that they might need significantly less than Tk 5 lakh to sustain and recover their business businesses in the next 90 days. One reason for this may be that 65 % of the companies surveyed were micro firms.

Some 18 percent of respondents said they want Tk 5 lakh to Tk 10 lakh, 8 percent need Tk 10 lakh to Tk 20 lakh and 5 percent said they want Tk 20 lakh to Tk 50 lakh.

Moderated by Yutaka Yoshino, the lead country economist of World Bank, Robert Chatterton Dickson, British high commissioner to Bangladesh, Abu Farah Md Naser, executive director of Bangladesh Bank, Arijit Chowdhury, additional secretary to Financial Institutions Division, and Judith Herbertson, development director of the FCDO, also spoke at the webinar.

Ananya Wahid Kader, a co-author of the report and senior functions officer at the IFC, gave a presentation on the survey.

Source: thedailystar.net//businessnews

Tags :

Previous Story

- Why are SMEs not availing the govt directed...

- Big borrowers gain, SMEs still in pain

- DU mentorship Program to greatly help cottage-to-medium enterprises...

- SME sector needs insurance policy support to create...

- Prime Bank joins SME Finance Forum to market...

- Garment factories in SME category to get cash...

- SMEs are in dire need of a lifeline...

- 67% of SMEs forced to shut businesses because...