Stocks dip 39-month low amid economic worries

Image collected

Turnover decreases 21.12%

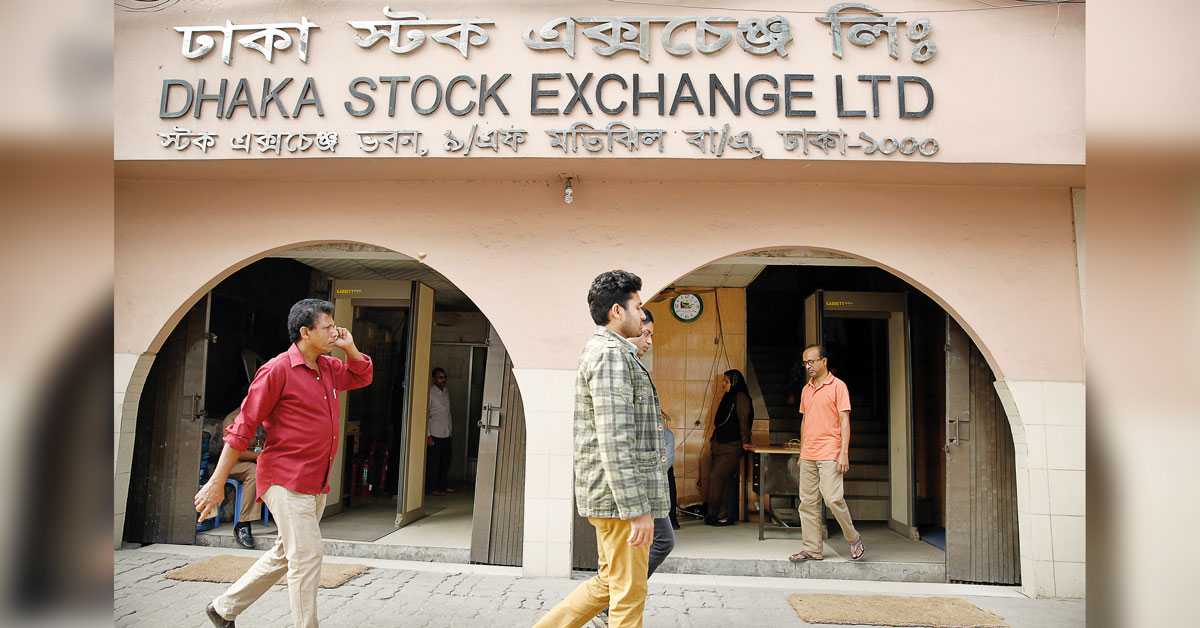

The country's prime bourse on Monday passed another day marked by significant selling pressure, losing 62.25 points or 1.35% of market capital in the process, amid growing concern over the country’s economy.

The sell-offs pulled down the DSEX, the key index of Dhaka Stock Exchange (DSE), to as low as 4,533.75 points. The last time the index hit its lowest was on August 31 of 2016, when it was down to 4,526 points.

On Monday, turnover dropped by 21.12% to Tk275 crore, which was Tk349 crore at the closing on Sunday.

Worry on the overall state of the economy is heightened, as export growth continues its downward trend. Private sector credit growth remains alarmingly low and stagnant amid persistent liquidity crisis within the banking sector with no easy solution to these problems in sight.

Stakeholders in the capital market also say that the trading in the capital market remained sluggish, as the investors have taken sideline approach due to the prevailing economic situation and had been skeptical regarding new investments.

EBL Securities in its daily market commentary said that the downward trend in export growth over the last four months, soaring non-performing loans (NPLs), and stagnant private sector credit growth further eroded the persistent lack of confidence on the part of the retail and institutional investors.

“Coupled with the selling of shares of large cap companies, especially in the pharmaceutical, energy, and food sectors, played a significant role in the overall dismal market outlook” the commentary said.

While talking to Dhaka Tribune, a top stock brokerage said that ratings of some of the country’s banks’ were lowered by the Moody’s; this move had an overall negative impact on the financial sector, hitting the stock market index hard.

The Board of Directors of DSE has decided to sit with the finance minister and the governor of Bangladesh Bank for a discussion concerning the prevailing crisis in the country's stock market. The decision was taken on Monday at a meeting of the DSE board.

According to the latest Bangladesh Bank data, NPLs of banks rose by a staggering Tk3,863.14 crore in three months till September of this year.

The total bad loans till September accounts for 11.99% of the total disbursed loans. By the end of June of this year, the total non-performing loans within the banking system stood at Tk1,12,425.17 crore, or 11.69% of the total disbursed loans.

The country’s export earnings decreased by $3.05 billion over a period of four months, from August to November of this year.

The fall has been largely driven by a sluggish growth in the apparel business, which contributes over 84% of total export earnings.

Market scenario on Monday

DSE Shariah-based index DSES declined 1.83% to end at 1,022.3 points, while blue-chip index, DS30, went down by 1.36% to close at 1,561.5 points.

The banking sector contributed 13.3% of the total turnovear, while pharmaceuticals, textile, and insurance sectors contributed 13.2%, 12.1%, and 11.4% respectively, according to the daily market analysis of UCB Capital Management Limited.

A total of 21 transactions in stocks of 10 companies worth Tk8.7 crore were executed in the block market of Dhaka Stock Exchange, according to the Detailed DSE Market Statistics.

Square Pharmaceuticals secured the leadership position on the top turnover chart with a turnover of Tk8.9 crore and its share price closing at Tk191.1 per share. Square Pharma was followed by Sinobangla Industries Ltd with a turnover of Tk7.6 crore, Daffodil Computers with Tk6.3 crore, British American Tobacco Bangladesh Company Ltd with Tk5.7 crore, and National Tubes with Tk5.2 crore.

New Line Clothings Ltd secured the highest gain of 8.9% during the day. Daffodil Computers turned out the worst loser with its stock price declining by 8.4%.

Among the traded stocks: 67 gained, 233 declined, and 53 remained unchanged at the Dhaka Stock Exchange, while 60 gained, 148 declined, and 29 remained unchanged at the Chittagong Stock Exchange (CSE).

The Dhaka Stock Exchange currently has a market capitalization of Tk344,652 crore. With Monday's significant drop, with the benchmark index DSEX losing about 1,416 points from its highest value of this year of 5,950 points since January 24, 2019.

The port city bourse Chittagong Stock Exchange (CSE) lost 151 points in its broad based index –CASPI. The port city bourse traded 52 crore shares and mutual fund units worth Tk14 crore.

There was a delay on Monday regarding posting of the updated turnover data on the DSE website due to technical problems.

Source: https://www.dhakatribune.com

Tags :

Previous Story

- LafargeHolcim tops turnover for second week

- SK Trims generates highest turnover

- Dhaka stocks return to positive

- New trading board approved for non-listed firms

- BSEC relaxes extension office rule for brokers

- DSE profits hit 7-yr low on market woes,...

- Stocks gain for 3rd day on GP, LafargeHolcim

- DSE daily turnover hits two-month high